MDB PROBASHI SAVINGS

MDB Probashi Savings is a savings account in local currency for the NRBs who are residing abroad and want to save their hard-earned money to utilize in Bangladesh. This is an interest bearing Taka account in which interest is paid twice a year.

| Title |

Details |

| Features and Benefits |

- No physical presence is required; Can be opened from abroad by sending duly completed AOF and all the required documents to Midland Bank NRB Banking Services.

- This is an interest bearing taka account in which interest is paid twice in year.

- No initial deposit required for opening this account.

- Interest calculated on the daily average balance.

- Higher interest rate on maintaining a certain balance in the account.

- Free VISA Debit card facility.

- 24X 7 access to largest network of VISA ATM and POS.

- No ledger fees/relationship charge (For the First year).

- Free Internet banking facility with fund transfer facility.

- E-commerce transactions can be also done through Internet Banking.

- Free SMS or Alert Banking (For the First year).

- Free Cheque Book Facility (For First Order).

- Account can be operated through mandate agreement.

- Dedicated email ID for any account related queries.

- Many lucrative investment and savings products can be linked with this account.

|

| Apply Eligibility |

- Any NRB who is between 18 to 65 years old can open this account.

- The NRB must have valid residence visa/work permit.

|

| Required Documents |

- Duly filled in Bank prescribed account opening form (download).

- Photo: 2 passport sized photographs of the Applicant.

- Nominee photo: 1 pp size attested by account holder on the reverse side.

- Identification Document: Photocopy of Valid passport (For old Bangladeshi passport first 6 pages; for MRP passport first 2 page with identification information).

In case of foreign passport attested photocopy of “no visa required for travel to Bangladesh” page required.

- Valid Proof of Residence: Valid Visa, Resident permit/work Permit/ Green Card. If it is any other language other than English, no translation is required.

- Address proof: (If any)- Resident /Work ID, Utility Bill, Pay Slip, Rent Receipts, Job Contract Letter, Health Card, Green Card, Social Security Card, Driving License, ID issued by government.

Required Documents for Joint Account Holder:

- If the Joint Account Holder’s Residence Status is Non Resident then, the similar list of documentations as the Primary Account Holder will be applicable for the Joint Account holder..

- If the joint Account Holder is a Resident then, the following Documents should be collected:

a. National ID / Passport Copy

b. Photo: 2 passport size

c. Address proof documents i.e. any utility bill, lease agreement

Requirements For Mandate Holder:

- One copy passport size photo of the Mandate (Attested by the Applicant)

- Valid photo ID of the Mandate

- Address proof document of the Mandate i.e. any utility bill, lease agreement

|

| MDB Probashi Account |

- Step 1: Download the MDB Probashi Savings FORM from the website: www.midlandbankbd.net

- Step 2: Please fill up the required information and put your sign on it.

- Step 3: Attach the required documents.

- Step 4: Please Send the Account opening Form and required documents through international postal mail to the following address:

Midland Bank NRB Banking Services

Head Office

N.B. Tower (Level 09)

40/7 North Avenue

Gulshan-2, Dhaka-1212

Bangladesh

For any clarifications, please e-mail at nrb.banking@midlandbankbd.net

|

| Frequently Asked Questions (FAQs) |

Q 1: What is MDB Probashi Savings?

Answer: It is an exclusive savings Account for the NRB’s that adds interest on daily basis and pays out on half yearly basis.

Q 2: What is the eligibility of a Client to open this account?

Answer:

- Must be a citizen of Bangladesh and age 18 years and above

- The NRB must have valid residence visa/work permit

Q 3: What are the Slabs of Interest Rates?

Answer: The slabs of the interest rates to be applied.

(Interest rate will be reset periodically upon review by Midland Bank PLC.' s Asset Liability Committee and will be subject to change as per deposit rate sheet)

Q 4: What are the unique features of this product?

Answer:

- No physical presence is required; Can be opened from abroad by sending duly completed AOF and all the required documents to Midland Bank NRB Banking Services

- This is an interest bearing taka account in which interest is paid twice in year

- No initial deposit required for opening this account

- Interest calculated on the daily average balance basis

- Higher interest rate on maintaining a certain balance in the account

- Free VISA Debit card facility

- 24X 7 access to largest network of VISA ATM and POS

- No ledger fees/relationship charge (For the First year)

- Free Internet banking facility with fund transfer facility

- E commerce transactions can be also done through Internet Banking

- Free SMS or Alert Banking

- Free Cheque Book Facility (For First Order)

- Account can be operated through mandate agreement

- Dedicated email ID for any account related queries

- Many lucrative investment and savings products can be linked with this account

Q 5: What about Interest Accrual & Payment Procedure?

Answer: Interest will be calculated on daily average balance of the account and paid on half yearly basis. *

*If the End of Day balance of the accounts falls below BDT 5,000.00, then for that particular day there will be no accrual of interest.

Q 6: What is the maximum allowed debit transaction per month to qualify for interest?

Answer: Maximum number of debit transactions allowed to qualify interest for the month is 10 (Ten).

Q 7: What about Tax Deduction on Interest?

Answer: Interest is tax deductible as per NBR rules.

Q 8: What about Excise Duty & VAT?

Answer: Excise Duty and VAT will be deducted as per NBR rules.

Q 9: As it is a NRB Account, then should not be the TAX, Excise Duty & VAT waived?

Answer: No, only income TAX is waived for NRBs. The tax on interest and excise duty and VAT for the deposited would be applicable as per NBR rules.

Q 10: Is there any option for repatriating the amount deposited in the MDB Probashi Savings to the overseas account directly?

Answer: Yes. Direct repatriation is possible with required regulatory approval.

Q 11: What are the points of Account opening?

Answer:

- All the Branches

- NRB Banking Services

- Customers can directly download the form from bank’s website and send the dully filled up form and required documents through international postal mail from the residing country.

Q 12: What would be the sending address if the customer is sending the account opening request from abroad?

Answer:

Midland Bank NRB Banking Services

Head Office

N.B. Tower (Level 09)

40/7 North Avenue

Gulshan-2, Dhaka-1212

Bangladesh

Q 13: What are the documents required for opening the account?

Answer: Bank prescribed account opening form duly filled up

-

- Photo: 2 passport size

- Nominee photo: 1 pp size attested by account holder attestation on the reverse side.

- Identification: Photocopy of Valid passport (6 pages) with due attestation. In case of foreign passport attested photocopy of “no visa required for travel to Bangladesh” page required.

- Valid VISA: Entry VISA with due attestation. If it is any other language other than English, no translation is required.

- Address proof: (If any)- Resident /Work ID, Utility Bill, Pay Slip, Rent Receipts, Job Contract Letter, Health Card, Green Card, Social Security Card, Driving License, ID issued by government

Q 14: Does the MDB Probashi Savings have joint application option?

Answer: Yes, Can be done.

Q 15: Who can be Joint Account Holder?

Answer: Any NRB/ Resident can be Joint Account Holder.

Q 16: What are the documents required for the Joint Account Holder?

Answer:

- If the Joint Account Holder is a NRB then, all the similar required documentations for MDB Probashi Savings would need to be collected from him/her.

- If the joint Account Holder is a Resident then, the following Documents should be collected:

- National ID/ Passport Copy

- Photo: 2 passport size

- Address proof documents i.e. any utility bill, lease agreement

Q 17: Who will fill up Transaction Profile Portion?

Answer: Client will fill up Transaction Profile (TP) at the time of opening of accounts mentioned in the account opening form.

Q 18: What about Nomination & deceased Account?

Answer:

- One person can be nominated by account holder for each account.

- Nomination will be cancelled, if nominee dies in the life time of account holder. Account holder, in such cases will advise in writing a new nominee.

- Account holder, with written instruction, may change the nominee any time.

- In the event of account holder’s death, his/her nominee will not be allowed to continue the account, and amount deposited prior to the death of account holder, shall be paid to the nominee, after proper identification.

Q 19: Can Mandate be assigned for MDB Probashi Savings?

Answer: Yes, one mandate holder can be assigned by the account holder/s for each account.

Q 20: Who can be assigned as a Mandate Holder?

Answer: Any Resident can be authorized as a Mandate Holder by the Account Holder/s to do the legitimate transactions into his/her account in absence of him/her in the country.

Q 21: If the MDB Probashi Savings is a Joint Account, then can any of the accountholder assign a Mandate Holder to the account?

Answer: All Joint-accountholders are required to sign regardless of mode of operation.

Q 22: What will be the authority for the Mandate holder to operate the account?

Answer: The Mandate holder can only do the legitimate debit and credit transactions. Any other account related operational issues i.e. any static data change request, Term deposit issuance/closure request, account closure, Internet banking /sms banking subscription request, Dormant/Inactive account activation request, Debit card issuance/renewal, cheque book renewal, statement request cannot be done through Mandate Holder or on the request of Mandate Holder.

Q 23: What are the documents required for assigning a Mandate Holder to MDB Probashi Savings?

Answer: The following Documents should be collected:

- Duly Filled up and Signed Mandate Authorization Letter

- Duly Filled up and Signed Mandate Details Form

- 1 Copy of Passport sized photograph of the Mandate attested by the Applicant/s

- Copy of National ID Card/ Passport of the Mandate

- Copy of Utility Bill as the address proof of the Mandate

Q 25: Can the Mandate Holder be authorized for using cheque book & Debit Card?

Answer: The Mandate holder can be authorized to use Account Holder’s cheque book only.

|

| Forms |

Download

For details, please feel free to contact any of our MDB NRB Service, Head Office

|

MDB DIGITAL PROBASHI SAVINGS ACCOUNT

This is an online Savings Account developed to facilitate the Non-Resident Bangladeshi (NRB) customers to open this account from anywhere and anytime through internet via the Bank’s website (www.midlandbankbd.net). The NRB customers who are working abroad and would like to save their earnings in Bangladesh for their family and for future benefits can open this account through MDB Website and avail the benefits. The product is designed in such a way that the customers do not need to visit branches except to make cash or cheque deposits as per their choice and convenience.

| Title |

Details |

| Product Description |

- The account can be opened through MDB website.

- The account will be opened in local currency (BDT).

- No initial deposit is required.

- Free Debit Card facility (Lifetime).

- Free Internet Banking facility.

- Free SMS Banking facility (1st year only).

- Free monthly e-statement facility.

- Daily ATM transaction amount of up to BDT 100,000 and daily POS transaction amount limit to be BDT 200,000 (max. 1 lac Tk. Per transaction). However, it can be increased at the request of the customer.

- Daily Debit Card transaction limit (up to 10 transaction, ATM + POS).

- Check book facility can be availed by physically visiting account bearing branch.at the time of traveling to Bangladesh.

|

| Eligibility |

- Any Non Resident Bangladeshi (NRB) residing abroad can open this account.

- Dual citizen holding foreign passport

|

| Availability |

|

| Minimum Initial Deposit Amount |

- There is no initial deposit required to open the account.

|

| Interest |

|

| Account Opening Process and Required Document |

- Bank’s prescribed online Digital Probashi Savings Account Opening Form (AOF) will be available in MDB website (www.midlandbankbd.net).

- The customer will fill-up the online form, generate a tracking number, and download the filled account opening form.

- The customer will sign in the required places of the account opening form, attach photographs including nominee’s photograph.

- The customer will then scan both account opening form and relevant documents and send those necessary documents through e-mail to the group email address of International Division and NRB, nrb.banking@midlandbankbd.net from his/her registered e-mail.

- International Division & NRB will conduct all the necessary checking, do necessary correspondence with the customer before account opening.

- If AOF and its relevant documents are found in order, then International Division & NRB will forward the file to respective branch for account opening.

- Respective Branch will open the account and e-mail the account number and other details to the customer with CC to International Division & NRB Group e-mail nrb.banking@midlandbankbd.net

Applicant Identification documents:

- In case of Bangladeshi Passport, photocopy of valid passport (first 2 pages) with identification information.

- In case of foreign passport, photocopy of the pages containing identification information and picture of the Applicant and the page that have the NVR seal /“No Visa Required for Travel to Bangladesh” will be additionally required.

Valid Residency Proof Documents:

- In case of Bangladeshi Passport, photocopy of valid Visa / Work Permit / Green Card / Residence Permit (if it is in any other language other than English, no translation is required).

Address Proof documents: Any of the following document will suffice-

- Work ID.

- Utility Bill.

- Pay Slip / Job Contract Letter.

- Driving License.

- Government issued ID Card.

- Credit Card Bills.

- Rent Receipts / Contracts.

- Health Card.

- Overseas Bank Statement.

Source of Income Proof documents: Any of the following document will suffice-

- Pay Slip / Job Contract Letter.

- Overseas Bank Statement.

- Overseas TAX Certificate.

- Any other valid document acceptable to the Bank.

Nominee Identification Document:

- Any Valid Copy of Photo ID of the Nominee(s).

- Nominee photo: 1 passport sized photograph for each Nominee(s) attested by account holder.

Note: The account opening procedure shall be strictly followed as per MDB Branch Operations Manual and Bangladesh Bank guidelines that may change from time to time.

|

| Document Endorsement and Attestation Process |

- It is NOT MANDATORY to send original documents to MDB Head Office or any concerned branch.

- If the applicant is NRB carrying VISA/port entry seal in their Bangladeshi passport, then NO attestation is required.

- If the applicant is Dual citizen carrying foreign documents like foreign passport, source of income document, then attestation will be required. The attestation can be done from the below organization by taking sign with seal of the respective official of that organization on the above photocopied document ('Original Seen' marking):

- Bangladesh High Commission

- Any MDBL affiliated Exchange House

- Any reputed Bank's branch

- Notary public in his/her currently residing country

|

| Joint Applicant Option |

- Customer can open the MDB Digital Probashi Savings Account either in the single name or in joint names.If anyone wants to open a joint account, the mode of operation of the account will be "Either or Survivor".

|

| Joint Applicant’s Required Documents |

In case of the joint Applicant is a Non Resident Bangladeshi:

- The similar documentations mentioned for the Applicant would need to be obtained.

In case of the Joint Applicant is a Resident Bangladeshi:

- National ID/ Passport Copy.

- Photocopy of valid Photo ID: Passport/National ID/ Birth Certificate (supported by valid Photo ID to be obtained as per BFIU, Bangladesh Bank guideline) .

- Photo: 2 passport sized.

- Address proof documents i.e. any utility bill, lease agreement.

|

| Interest Accrual, Payment & Forfeiture Rules |

- Interest will be calculated on End of Day (EOD) balance of the account and applied to the account on a monthly basis.

- The customers may withdraw fund any time without losing interest on the End of Day (EOD) balance. However, if a customer does more than 10 transactions (either through ATM or POS) in a day, the interest will be forfeited for the month.

|

| Cheque Book Facility |

- Cheque book shall be allowed only after visiting concerned branch by the customer.

- Online Application shall not be entertained.

- Signature Card shall be taken and uploaded in the CBS only after visiting the account bearing branch by the account holder.

|

| Debit Card Facility |

- Debit Card is MANDATORY. If the customer requests for a Debit Card, the account must be activated first by fulfilling all the necessary criteria as per the Bank’s requirements and the customer must have an available balance of at least BDT 1,000.

- The annual fees for the Debit Card is waived for LIFETIME. However, for any card replacement (lost/stolen/damaged), the customer needs to pay as per “Schedule of Charge” of the Bank.

- The Debit Card and its PIN will be sent to the customers’ foreign address through 2 different couriers in different days through reputed insured courier services. However, the customer must bear the courier charge (at actual) if s/he wishes to get it delivered it to the desired foreign address.

- The customer can also choose to avail the card while s/he will be available in Bangladesh to physically collect the Debit Card and it’s PIN.

|

| Debit Card Transaction Limit |

- The Debit Card transaction limit is restricted to 10 transactions in a day. However, the customer may request to increase the number of transaction limit in a day based on his/her requirement. In that case, the interest will be forfeited (for more than 10 transaction in a day) for the month.

- A customer can withdraw up to BDT 100,000 through ATM and up to BDT 200,000 (max. 1 lac Tk. Per transaction) through POS in a day. However, the customer may request to increase/decrease the limit as per their convenience.

- The above transaction limits must be supported by the Transaction Profile (TP) declared by the customers.

|

| Internet Banking Facility |

- Internet Banking Facility (midland online) is MANDATORY for all the accounts under this product.

|

| Account Maintenance Fee |

|

| Account Closure Fee |

|

| Other Fees & Charges |

- Government Excise Duty is applicable.

- Withholding Tax is applicable on the interest earned in the account which will be deducted at source. The operation of MDB Digital Probashi Savings Accounts are subject to the laws, banking regulations or banking practices that may change from time to time.

- All Taxes / Duty / levy and/or any other surcharges presently in force or that may be imposed by the Government of Bangladesh from time to time will be deducted/recovered from the account.

|

MDB NFCD ACCOUNT

| Title |

Details |

| Eligibility/Target Segment |

- Non Resident Bangladeshi Nationals/NRBs/Dual Citizens with Bangladeshi origin.

- Any Bangladeshi Nationals serving with Embassies/High Commissions of Bangladesh in foreign

countries/Officers and staffs of the government/semi government departments/nationalized banks and

employees of body corporate posted abroad ore deputed with international and regional agencies like

IMF, World Bank, IDB, ADB etc. During their assignments can also open this account.

- The Shore Staffs in Bangladeshi Shipping companies who are posted abroad*

*The crew members of Bangladeshi shipping companies are not eligible to open this account

|

| Features |

- This is an interest bearing term deposit account.

- Can be opened for the tenures of one /three/six and twelve months.

- This account can be maintained in Pound, US Dollar, Pound, Euro or Japanese Yen.

- Minimum Balance is USD 1000 or GBP 500 or equivalent in other currencies.

- The balance and the accrued interest of this account can be freely transferable abroad without any

prior permission from Bangladesh Bank.

- The interest accrued on this account is fully exempted from Tax.

- Cheque book facility is available with this account.

|

| Permissible Credits |

- Foreign Currency brought in at the time of their return from travel abroad. However, if it exceeds US

5000 (or its equivalent) then should be declared to the customs on "FMJ form" at the time of arrival.

- Inward remittance.

- Transfer from any other Foreign Currency Accounts.

- Can be also credited from the convertible foreign exchange i.e. currency notes, travelers cheques,

drafts etc. brought into Bangladesh while their temporary visit. However, if it exceeds US 5000 (or

its equivalent) then should be declared to the customs on "FMJ form" at the time of arrival.

|

| Permissible Debits |

- Local withdrawals can be made in taka only.

- Freely transferable/repatriable with the accrued interest to the own account/any beneficiary Accounts

maintained abroad.

|

| Required Documents |

- 2 copies of passport sized photographs of the Applicant

Applicant Identification documents:

- In case of Bangladeshi Passport, photocopy of valid passport (first 2 pages) with identification

information.

- In case of foreign passport, photocopy of the pages containing identification information and picture

of the Applicant and the page that has the NVR seal /“No Visa Required for Travel to Bangladesh” will

be additionally required

Valid Residency Proof Documents:

- In case of Bangladeshi Passport, photocopy of valid Visa / Work Permit / Green Card / Residence

Permit (if it is in any other language other than English, no translation is required)

Address Proof documents:(Any of the following copy of document will

suffice)

- Work ID

- Utility Bill

- Pay Slip / Job Contract Letter

- Driving License

- Government issued ID Card

- Credit Card Bills

- Rent Receipts / Contracts

- Health Card

- Overseas Bank Statement

Source of Income Proof documents: (Any of the following copy of document will

suffice)

- Pay Slip / Job Contract Letter

- Overseas Bank Statement (Not older than three months from the account opening date)

- Overseas TAX Certificate

- Any other valid document acceptable that proofs Applicant’s legitimate income source

Nominee Identification Document:

- Any Valid Copy of Photo ID of the Nominee(s)

- Nominee photo: 1 passport sized photograph for each Nominee(s) attested by the Applicant.

- Duly Filled in Account opening Form.

|

| Steps: NFCD Account |

- Step 1: Download the Non Resident Foreign Currency Deposit Account (NFCD

Account)FORM from the website: www.midlandbankbd.net

- Step 2: Please fill up the required information and put your sign on it.

- Step 3: Attach the required documents.

- Step 4: Please Send the Account opening Form and required documents through

international postal mail to the following address:

Midland Bank NRB Banking Services

Head Office

N.B. Tower (Level 09)

40/7 North Avenue

Gulshan-2, Dhaka-1212

Bangladesh

|

| NFCD Account Download Forms |

Download Account

Opening Form

For details, please feel free to contact any of our MDB NRB Service, Head Office

|

MDB FC ACCOUNT

| Title |

Details |

| Eligibility/Target Segment |

- Bangladeshi Nationals residing abroad/NRBs/Dual Citizens with Bangladeshi origin.

- Resident Bangladeshi nationals working with Foreign /International Bodies whose salary are disbursed fully and partially* in Foreign Currency.

- Foreign Nationals residing in abroad or in Bangladesh.

- Foreign Firms Registered abroad and operating in Bangladesh and abroad.

- Foreign Missions and their Expatriate employees.

Note: *For partial Salary Disbursement only the portion in FC can be credited to this account.

|

| Features |

- This is a non interest bearing account.

- This account can be maintained in US Dollar, Pound, Euro or Japanese Yen.

- No initial deposit required for opening this account.

- The balance of this account is fully repatriable without any prior permission from Bangladesh Bank.

- Local disbursements can be made freely in BDT only at the prevailing exchange rate.

- Option to have a mandate holder to maintain the account in absence of the account holder.

- Cheque book facility is available with this account.

|

| Permissible Credits |

- Inward remittance.

- Transfer from any other Foreign Currency Accounts of abroad.

- Non Residents Taka Accounts of Banks abroad.

- Can be also credited from the convertible foreign exchange i.e. currency notes, travelers cheques, drafts etc. brought into Bangladesh while NRBs’ temporary visit. However, if it exceeds US 5000 (or its equivalent) then should be declared to the customs on "FMJ form" at the time of arrival.

|

| Permissible Debits |

- Local withdrawals can be made in taka only.

- Freely transferable/repatriable to the own account/any beneficiary Accounts maintained abroad from the balance.

|

| Required Documents FC Account (Individual) |

For Bangladeshi Nationals Residing abroad (NRBs)/Dual Citizens with Bangladeshi origin

- Two Copies of passport sized recent photographs of the Applicant.

- Photocopy of first six pages of the Bangladeshi passport. In case of foreign passport, photocopy of the page that says ‘no visa required to travel to Bangladesh’

- Copy of Valid Visa/Work Permit/ Resident Card.

- Proof of income i.e. Salary / Pay Slip, Job Contract letter /Tax Certificate/Business license /overseas bank statement (not old than three months from the account opening date) or any other document that proofs applicant legitimate income source.

- Note: At least one of the following documents as proof of overseas address (photocopy):

- Work ID.

- Resident Permit.

- Utility Bill.

- Pay Slip.

- Driving License.

- Government issued ID card.

- Credit Card Bills.

- Rent Receipts.

- Over seas Bank Statement.

- One copy of passport sized photograph of the Nominee attested by the Applicant.

- Duly Filled in Account opening Form.

For Bangladeshi Nationals Residing in Country

- Two Copies of passport sized recent photographs of the Applicant.

- Photocopy of first six pages of Bangladeshi passport.

- Proof of income i.e. Salary / Pay Slip, Job Contract letter or any other document that proofs applicant legitimate income source in Foreign Currency.

- Copy of local address proof document (Rental agreement, Utility Bill etc.).

- One copy of passport sized photograph of the Nominee attested by the Applicant.

- Duly Filled in Account opening Form.

For Foreign Nationals residing in abroad or in Bangladesh/Foreign missions’ Expatriate Employees

- Two Copies of passport sized recent photographs of the Applicant.

- Copy of Valid Passport the Applicant.

- Copy of Valid Visa (if the Applicant is residing in Bangladesh only).

- Copy of BOI Permission Visa (if the Applicant is residing in Bangladesh only).

- Proof of income i.e. Salary / Pay Slip, Job Contract letter ,business account statements, Tax Certificate or any other document that proofs applicant legitimate income source.

- Any local Address proof document.

- copy of passport sized photograph of the Nominee attested by the Applicant.

- Duly Filled in Account opening Form.

- Required Documents for assigning a Mandate Holder

- One copy passport size photo of the Mandate (Attested by the Applicant).

- Valid photo ID of the Mandate.

- Address proof document of the Mandate.

- Duly filled in Mandate Authorization Form.

|

| Steps: FC Account |

- Step 1: Download the Foreign Currency Account (FC Account)FORM from the website: www.midlandbankbd.net

- Step 2: Please fill up the required information and put your sign on it.

- Step 3: Attach the required documents.

- Step 4: Please Send the Account opening Form and required documents through international postal mail to the following address:

-

Midland Bank NRB Banking Services

Head Office

N.B. Tower (Level 09)

40/7 North Avenue

Gulshan-2, Dhaka-1212

Bangladesh

- For any clarifications, please e-mail at nrb.banking@midlandbankbd.net

|

| Forms |

Download Account Opening Form

For details, please feel free to contact any of our MDB NRB Service, Head Office

|

WAGE EARNER'S DEVELOPMENT BOND (WEDB)

Probashi Wage Earner Development Bond (WEDB) is a product offered by Bangladesh Central Bank for the Non Resident Bangladeshis (NRBs) to invest their hard earned money for earning a safe and tax free income with the assurance of a very steady and lucrative interest rate.

| Title |

Details |

| Features and Benefits |

- This bond can be purchased in the denomination of BDT 25000, 50000, 100000, 200000, 500000, 1000000, 5000000.

- The purchaser can purchase Bond any amount in multiples of BDT. 25,000/- without any maximum limit.

- The interest rate is 12% per annum payable on half-yearly basis.

- The tenure is five years.

- Tax exemption on the principal.

- Can be used as security for any loan.

- Death risk benefit up to 40% to 50% (Up to BDT 500,000) of investment.

- Auto renewal option available.

- Investors of BDT 80 Million and above shall be treated as CIP.

- Purchaser of Wage Earner's Development Bond can repatriate the principal amount of the bond in foreign currency.

|

| Applicable Interest Rate |

The slabs of the interest rates to be applied are as follows:

|

Tenure

|

Applicable Interest Rate

|

| Before 6 Months |

No Interest

|

| Above 6 Months to 1 Year |

8.70%

|

| Above 1 Year to 1.5 Years |

9.45%

|

| Above 1.5 Years to 2 Years |

10.20%

|

| Above 2 Years to 5 Years |

11.20%

|

| After 5 Years |

12.00%

|

(Interest rate might be reset periodically upon review by Bangladesh Bank)

|

| Required Documents |

Required Documents for purchasing Bonds

- The purchaser must have a photocopy of the relevant pages of the passport with the purchasers name, date of birth, date and place of issue; expiry date, photograph and signature appear (In case of foreign passport holders including the page where it appears “NO VISA REQUIRED TO TRAVEL TO BANGLADESH” )

- 02 Copy passport sized photographs of the Bond Holder & 2 copy for the Nominee

- Income source proof documents of the purchaser

- 03 Copies of Mandate holder photographs, with A/c holder’s signature on the back

- Duly filled out and signed Mandate holder application

- Duly Filled out Application for Bonds

- Duly filled out debit Instruction Form

- The purchaser must have a FC account for any kind of bond

- The purchaser of Wage Earner Development & US Dollar Investment Bond must have to maintain a MDB Probashi Savings along with FC account

- Copy of Bond Purchaser National ID issued by Government of Bangladesh

|

| Steps: Wage Earner's Development Bond (WEDB) |

- Step 1: Download the Wage Earner's Development Bond (WEDB) FORM from the website: www.midlandbankbd.net

- Step 2: Please fill up the required information and put your sign on it.

- Step 3: Attach the required documents.

- Step 4: Please Send the Bond opening Form and required documents through international postal mail to the following address:

Midland Bank NRB Banking Services

Head Office

N.B. Tower (Level 09)

40/7 North Avenue

Gulshan-2, Dhaka-1212

Bangladesh

For any clarifications, please e-mail at nrb.banking@midlandbankbd.net

|

| Frequently Asked Questions (FAQs) |

Download

wedbond FAQ

For details, please feel free to contact any of our MDB NRB Service, Head Office

|

| Forms |

Download

WEDB Opening Form

For details, please feel free to contact any of our MDB NRB Service, Head Office

|

US DOLLAR INVESTMENT BOND

US Dollar Investment Bond is a product offered by Bangladesh Central Bank for the Non Resident Bangladeshis (NRBs) to invest their hard earned money for earning a safe and tax free income with the assurance of a very steady and lucrative interest rate.

| Title |

Details |

| Features and Benefits |

- This bond can be issued in the denomination of US $500, $1000, $5000, $10,000 and $50,000.

- Can be purchased of any amount in multiples of US $500 without a maximum limit.

- The tenure is three years.

- The interest rate is 7.5 % per annum payable on half-yearly basis in Bangladeshi taka.

- The interest is payable only in Bangladeshi Taka.

- Auto renewal option available.

- Can be used as security for any loan.

- Tax exemption on the principal and interest amount.

- The principal and interest will be payable in US Dollar.

- Investors of one Million US Dollar and above shall be treated as CIP.

- Death risk benefit up to 15% to 25% (Up to BDT 2,000,000) of investment.

- Principal can be repatriated in the foreign country.

|

| Applicable Interest Rate |

The slabs of the interest rates to be applied are as follows:

|

Tenure

|

Applicable Interest Rate

|

| Before 1 year from the date of issue |

No Interest

|

| Completion of 1 Year |

05.50%

|

| Completion of 2 years |

06.00%

|

| Completion of 3 years |

06.50%

|

(Interest rate might be reset periodically upon review by Bangladesh Bank)

|

| Required Documents |

- The purchaser must have a photocopy of the relevant pages of the passport with the purchasers name, date of birth, date and place of issue; expiry date, photograph and signature appear (In case of foreign passport holders including the page where it appears “NO VISA REQUIRED TO TRAVEL TO BANGLADESH” )

- 02 Copy passport sized photographs of the Bond Holder & 2 copy for the Nominee

- Income source proof documents of the purchaser

- 03 Copies of Mandate holder photographs, with A/c holder's signature on the back

- Duly filled out and signed Mandate holder application

- Duly Filled out Application for Bonds

- Duly filled out debit Instruction Form

- The purchaser must have a FC account for any kind of bond

- The purchaser of Wage Earner Development & US Dollar Investment Bond must have to maintain a MDB Probashi Savings along with FC account

- Copy of Bond Purchaser National ID issued by Government of Bangladesh

|

| Steps: US Dollar Investment Bond |

- Step 1: Download the US Dollar Investment Bond FORM from the website: www.midlandbankbd.net

- Step 2: Please fill up the required information and put your sign on it.

- Step 3: Attach the required documents.

- Step 4: Please Send the Bond opening Form and required documents through international postal mail to the following address:

Midland Bank NRB Banking Services

Head Office

N.B. Tower (Level 09)

40/7 North Avenue

Gulshan-2, Dhaka-1212

Bangladesh

For any clarifications, please e-mail at nrb.banking@midlandbankbd.net

|

| Frequently Asked Questions (FAQs) |

Download

US Dollar Investment Bond FAQs

For details, please feel free to contact any of our MDB NRB Service, Head Office

|

| Forms |

Download

US Dollar Investment Bond Opening Form

For details, please feel free to contact any of our MDB NRB Service, Head Office

|

US DOLLAR PREMIUM BOND

US Dollar Premium Bond is a product offered by Bangladesh Central Bank for the Non Resident Bangladeshis (NRBs) to invest their hard earned money for earning a safe and tax free income with the assurance of a very steady and lucrative interest rate.

| Title |

Details |

| Features and Benefits |

- This bond can be issued in the denomination of US $500, $1000, $5000, $10,000 and $50,000.

- Can be purchased of any amount in multiples of US $500 without a maximum limit.

- The tenure is three years.

- The interest rate is 7.5 % per annum payable on half-yearly basis in Bangladeshi taka.

- The interest is payable only in Bangladeshi Taka.

- Auto renewal option available.

- Can be used as security for any loan.

- Tax exemption on the principal and interest amount.

- The principal and interest will be payable in US Dollar.

- Investors of one Million US Dollar and above shall be treated as CIP.

- Death risk benefit up to 15% to 25% (Up to BDT 2,000,000) of investment.

- Principal can be repatriated in the foreign country.

|

| Applicable Interest Rate |

The slabs of the interest rates to be applied are as follows:

Tenure |

Applicable Interest Rate |

Before 1 year from the date of issue |

No Interest |

Completion of 1 Year |

06.50% |

Completion of 2 years |

07.00% |

Completion of 3 years |

07.50% |

(Interest rate might be reset periodically upon review by Bangladesh Bank)

|

| Required Documents |

- The purchaser must have a photocopy of the relevant pages of the passport with the purchasers name, date of birth, date and place of issue; expiry date, photograph and signature appear (In case of foreign passport holders including the page where it appears “NO VISA REQUIRED TO TRAVEL TO BANGLADESH” )

- 02 Copy passport sized photographs of the Bond Holder & 2 copy for the Nominee

- Income source proof documents of the purchaser

- 03 Copies of Mandate holder photographs, with A/c holder's signature on the back

- Duly filled out and signed Mandate holder application

- Duly Filled out Application for Bonds

- Duly filled out debit Instruction Form

- The purchaser must have a FC account for any kind of bond

- The purchaser of Wage Earner Development & US Dollar Investment Bond must have to maintain a MDB Probashi Savings along with FC account

- Copy of Bond Purchaser National ID issued by Government of Bangladesh

|

| Steps: US Dollar Premium Bond |

- Step 1: Download the US Dollar Premium Bond FORM from the website: www.midlandbankbd.net

- Step 2: Please fill up the required information and put your sign on it.

- Step 3: Attach the required documents.

- Step 4: Please Send the Bond opening Form and required documents through international postal mail to the following address:

Midland Bank NRB Banking Services

Head Office

N.B. Tower (Level 09)

40/7 North Avenue

Gulshan-2, Dhaka-1212

Bangladesh

For any clarifications, please e-mail at nrb.banking@midlandbankbd.net

|

| Frequently Asked Questions (FAQs) |

Download

US Dollar Premium Bond FAQs

For details, please feel free to contact any of our MDB NRB Service, Head Office

|

| Forms |

Download

US Dollar Premium Bond Opening Form

For details, please feel free to contact any of our MDB NRB Service, Head Office

|

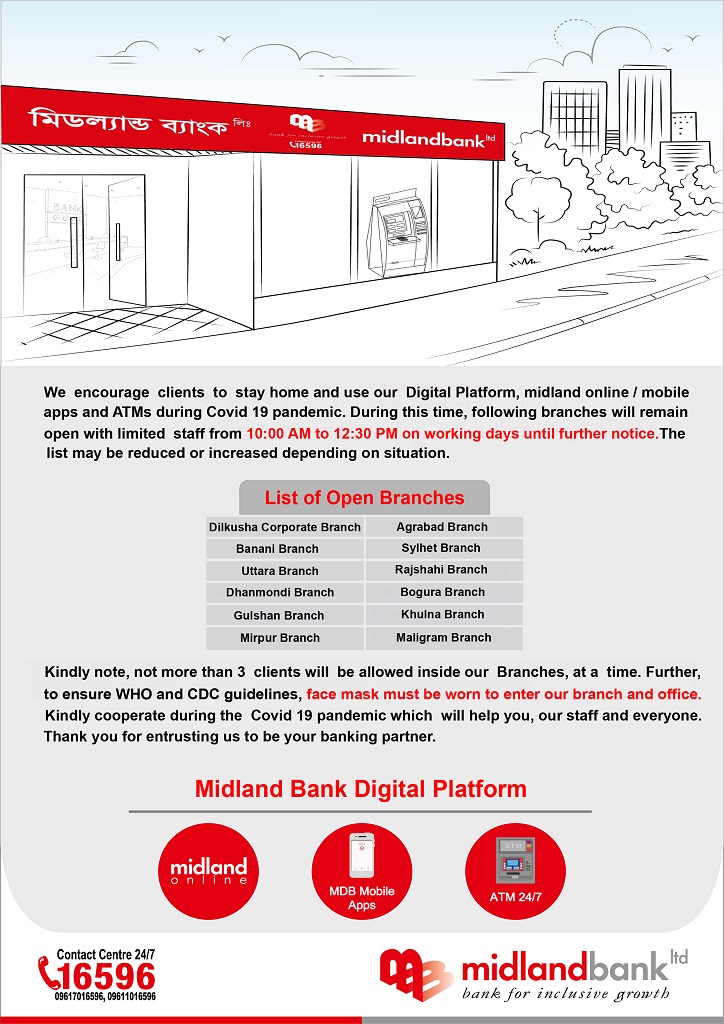

MDB FOREIGN REMITTANCE SERVICE

Midland Bank has relationships with the leading Money Transferring Companies all around the world. MDB aims to disburse the remittance money to your beneficiaries in as little as 10 minutes, making it as simple to do and hassle free.

Your beneficiary can receive money in two ways. They are:

- Over the bank counter and/or

- Beneficiary’s bank account.

Midland Bank Remittance Disbursement Network

MDB Remittance Partners

| SL NO. |

EXCHANGE HOUSE NAME |

COUNTRY OF ORIGIN |

OPERATING COUNTRIES |

|

| 1 |

BRAC SAAJAN EXCHANGE LTD. |

UK |

UK, IRELAND, POTUGAL,SPAIN, ITALY, FRANCE |

|

| 2 |

CONTINENTAL EXCHANGE SOLUTIONS. INC, USA (RIA) |

USA |

GLOBAL |

|

| 3 |

INSTANT CASH |

UAE |

GLOBAL |

|

| 4 |

PRABHU GROUP INC. |

USA |

GLOBAL |

|

| 5 |

PLACID NK CORPORATION, USA |

USA |

GLOBAL |

|

| 6 |

WESTERN UNION |

USA |

GLOBAL |

|

| 7 |

XPRESS MONEY SERVICES LTD |

UAE |

GLOBAL |

|

MDB Nostro Accounts

| SL NO. |

CURRENCY NAME |

BANK NAME |

BANK ADDRESS |

ACCOUNT NO |

SWIFTCODE |

|

| 1 |

US Dollar |

AB Bank Ltd |

Liberty Building, 41-42 Sir Vithaldas Thackersey Marg |

5001-000069-155 |

ABBLINBB |

|

| 2 |

US Dollar |

United Bank of India |

4, N.C.Dutta Sarani Calcutta-700 001, India. |

0084050096733 |

UTBIINBBCAL |

|

| 3 |

US Dollar |

AXIS Bank Ltd |

AXIS House, Worli Mumbai, India |

913020052056634 |

AXISINBB004 |

|

| 4 |

EURO |

United Bank of India, Calcutta Branch |

4, N.C.Dutta Sarani, Calcutta-700 001, India. |

0084050096742 |

UTBIINBBCAL |

|

| 5 |

EURO |

MashreqBank Psc |

1st Floor, 2 London Wall Buliding London, EC2M 5PP |

00013269 |

MSHQGB2L |

|

| 6 |

EURO |

AKTIF YATIRIM BANKASI A.S. |

Aktif Yatirim Bankasi A.S.PNSC Building, Genel Müdürlük Büyükdere Caddesi No: 163, Zincirlikuyu Sisli 34394 Istanbul, Turkey. |

TR160014300000000003892390 |

CAYTTRISXXX |

|

| 7 |

GBP |

MashreqBank Psc |

1st Floor, 2 London Wall Buliding London, EC2M 5PP |

00013258 |

MSHQGB2L |

|

| 8 |

JPY |

National Bank of Pakistan Main Branch |

CJ Bldg 3F, J -4, 2chome Nishi Shimbashi, Minato-Ku, Tokyo 105-0003 Japan |

21125 |

NBPAJPJT |

|

| 9 |

US Dollar |

Mashreq Bank Psc |

50 Broadway, Suite 1500, New York, NY 10004. USA |

70010119 |

MSHQUS33 |

|

| 10 |

US Dollar |

Kookmin Bank |

Foreign Exchange Business Dept. 5/F, Kookmin Bank H.Q Building 84, Namdaemun-ro, Jung-gu Seoul, Korea 100-703. |

862-8-USD-01-9 |

CZNBKRSEXXX |

|

| 11 |

US Dollar |

Habib American Bank |

99 Madison Avenue New York, NY 10016, U.S.A. |

20729121 |

HANYUS33XXX |

|

| 12 |

US Dollar |

MCB Bank Limited |

Export Processing Zone Branch,(Offshore Banking Unit) Export Processing Zone,

Landhi Industrial Area, (Extension) Mehran Highway, Landhi, Karachi, Pakistan. |

0000000015619082 |

MUCBPKKA |

|

MDB STUDENT FILE SERVICES

MDB Student File Service is a customized banking solution for students which eases

educational related financial transactions abroad. Through Student File, students can pay for their tuition fees and

living expenses overseas .Student File opening is a mandatory requirement set by Bangladesh Bank for Foreign

Exchange transfer to other countries. (Study criterion is described in FE circular (F. E Circular: 11, No: 5))

SERVICES OFFERED UNDER MDB STUDENT’S FILE SERVICE

- Opening/Processing student File: MDB will open, process and maintain a file for each student

till completion of the course.

- Fund Transfer Facility: Tuition fees and living expenses can be transferred Foreign Demand

Draft (FDD)/ Foreign Telegraphic Transfer (FTT) /SWIFT in favor of Educational institutions abroad.

Tenure of a file

Once a student file is opened, that file stays with that bank, which means, for progressive

semesters, the file will be operated from that bank. In case of genuine exceptions, where the customer has to move

the account in another bank, then transfer will take place between banks.

| Title |

Details |

| Features |

- Convenient fund transfer of Tuition Fess & Living expenses for the entire academic period

- Legitimate method of remitting to another country and can be used effectively for future

reference

- Flexibility of Foreign Currency endorsement

- Competitive exchange rate

- Faster processing of Student File

|

| Eligibility |

ELIGIBILITIES FOR OPENING STUDENT FILEPENING STUDENT FILE

Midland Bank will open the student file for following regular courses such as:

- Undergraduate.

- post graduate

- Language course pre-requisite to bachelor degree

- Professional diploma/certificate courses i.e.

- Commercial Flying

- Computer Programming

- Hotel Management and Catering

- Chartered Accountancy

- Cost & Management Accountancy are special fields for which students are allowed to open Student

File.

N.B: Language, diploma, separate foundation course is not allowed

|

| Account Relationship |

Account relationship is mandatory to open a student file. Account can be opened in single name of the

financer/ joint name- Financer & Student (any One can operate) for debiting the remittance.

|

| Required Documents |

In case of new files: as per FE Circular-11 No: 10(A), following documents are required to be submitted

by the student with attested photocopies:

- Original offer letter from overseas institution with acceptance of admission / registration /

I-20 for USA institution need to be accompanied containing following information:

- Course name

- Course start date

- Course duration

- Details of annual expenses (tuition and living) from respective institution(in case of advance

payment refund policy should be mentioned)

- Original academic certificates& transcripts. (SSC, HSC, O & A level, diploma, graduation,

post-graduation including IELTS, TOEFL if any) ( originals need to be shown at the branch)

- Original Valid Passport & VISA of student (Pre-visa declaration for Australian institutions)

- Detail information of the person financing the student with a copy of Passport size photo.

Note: Both the student & the financer should be present in person at the time of

opening student file.

In case of subsequent term(s) payment: ( FE Circular-11 No: 10(F))

- Certificate/ record from institution on continuation of studies

- Progress report / transcript

- Revised expense estimate for next academic year

Student Quota:

Education Cost & Living Cost as per estimate furnished by Foreign Institution/University and USD 200 or

equivalent for transit expenses

|

| Fees and Charges |

Student File Fee:

- Student File Opening Fee: BDT 5000

- Student File Renewal Fee: BDT 3000

- Outward Remittance Transaction Fees: BDT 500.00 (maximum) for each subsequent transaction

- Foreign Correspondent Bank charges for outward remittance : At Actual

Note: 15% Vat is applicable on all fees

|