| Key Benefits |

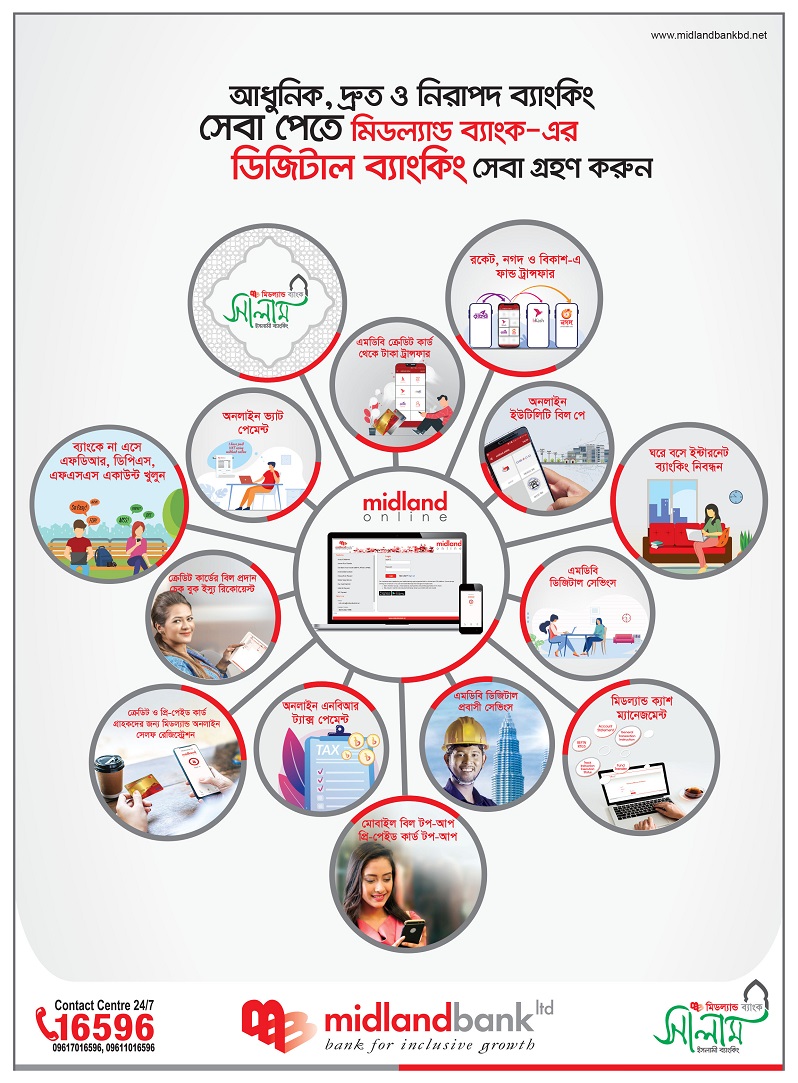

- The account can be opened through MDB website

- This is a Transactional savings account

- The accounts will be in local currency (BDT)

- No initial deposit is required

- Free Debit Card facility (Lifetime)

- Free Internet Banking facility

- Free SMS Banking facility (1st year only);

- Free monthly e-statement facility

- Daily ATM transaction amount of up to BDT 50,000 and POS transaction amount of up to BDT 50,000. However, it can be increased at the request of the customer

- Daily Debit Card transaction limit (up to 10 transactions, ATM + POS)

- 50% waiver on Foreign Currency endorsement

- A one time in person meeting is needed for introduction and obtaining original ID documents as per BANGLADESH BANK regulation. If within 35 KM of any of our Branches, Banking Booths or Agent Banking Centres, one of our staff will visit you. If outside 35 KM, the one time visit to any of our offices is needed for introduction and submission of original ID documents.

|

| Eligibility |

- Any Resident Bangladeshi citizen can open this account.

|

| Joint Applicant Option |

- Customer can open the MDB Saalam Digital Savings Account either in the single name or in joint names.

|

| Availability |

- Through MDB website (www.midlandbankbd.net)

|

| Minimum Initial Deposit Amount |

- There is no initial deposit required to open the account. However, to request/issue a debit card, the customer needs to maintain a minimum deposit of BDT 1,000.

|

| Account Opening Process and Required Document |

- Bank’s prescribed online Account Opening Form (AOF) that will be available in MDB website (www.midlandbankbd.net).

- 02 (Two) passport size photographs of account holder(s) attested by the introducer

- 02 (Two) passport size photographs of Legal Guardian attested by the introducer (applicable for minor account)

- Photocopy of valid Photo ID: Passport/National ID/ Birth Certificate (supported by valid Photo ID to be obtained as per BFIU, Bangladesh Bank guideline) of the account holder(s)/Legal Guardian attested by the introducer.

- 01 (one) passport size photograph of nominee(s) attested by account holder(s).

- Photocopy of valid Photo ID: Passport/National ID/ Birth Certificate (supported by valid Photo ID to be obtained as per BFIU, Bangladesh Bank guideline) of the nominee(s)/legal guardian (if any) attested by the account holder(s).

- The account opening procedure shall be strictly followed as per MDB Branch Operations Manual and Bangladesh Bank guidelines that may change from time to time.

|

| Mode of Shariah |

|

| Profit Rate and Profit Sharing Ratio |

- The provisional profit rate and profit sharing ratio will be reset periodically upon review by MDB’s Asset Liability Committee (ALCO) and will be subject to change as per deposit rate sheet. However the original profit rate will be determined at the end of the year

|

| Profit Accrual, Payment & Forfeiture Rules |

- Profit will be calculated on End of Day (EOD) balance of the account and applied to the account on a monthly basis.

- The customers may withdraw fund any time without losing profit on the End of Day (EOD) balance. However, if a customer does more than 10 transactions (either through ATM or POS) in a day, the profit will be forfeited for the month.

|

| Debit Card |

- Debit Card is MANDATORY. However, to request/issue a debit card, the customer needs to make an initial deposit of minimum BDT 1,000. The annual fees for the debit card is waived for LIFETIME. However, for any card replacement (lost/stolen/damaged), the customer needs to pay as per “Schedule of Charge” of the Bank.

|

| Cheque Book |

- No Cheque Book will be allowed/issued under this product

|

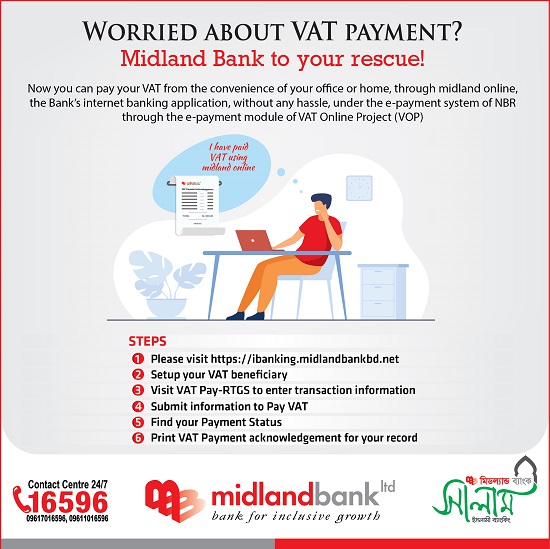

| Internet Banking Facility |

- Internet Banking Facility (midland online) is MANDATORY for all the accounts under this product.

|

| Account Maintenance Fee |

- As per schedule of charges of MDB

|

| Account Closure Fee |

- As per schedule of charges of MDB.

|

| Tax, Excise Duty & VAT |

- Will be deducted as per NBR rules

|