Financial Literacy Program

Financial literacy is the education and understanding of how money is made, spent, and saved, as well as the skills and ability to use financial resources to make decisions. These decisions include how to generate, invest, spend, and save money. Financial literacy is essential in order to promote financial inclusion, especially in the context of the advancement of Digital Financial Services (DFS).

2025

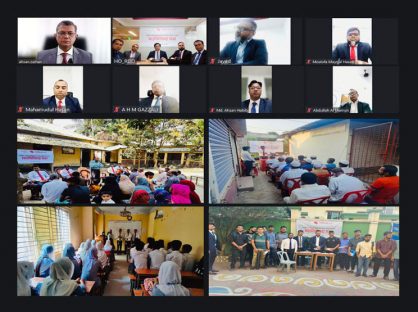

Midland Bank has celebrated Financial Literacy Week from 17-23 March, 2025 throughout the country by MDB Branches, Sub-Branches & Agent Banking Centers at their premises or outsides. The bank has conducted a zoom meeting with all officers of branches, sub-branches and agent centers where the theme provided by Bangladesh Bank “Think before you follow, wise money tomorrow” & under this theme some topics such as Finfluencers, Herd Mentality, Biased advice and Peer or social media pressure are explained for sharing ideas with customers and societies particularly with young generation. Some digital contents are also circulated in social media pages of the bank. Besides, the yearlong financial literacy theme (আর্থিক খাতে অংশগ্রহণ, নারীর অধিকার) is also emphasized during discussion.

Midland Bank PLC. has celebrated Financial Literacy Day-2025. Mr. Md. Zahid Hossain, Deputy Managing Director of the Bank & Chairman of Financial Literacy Wing inaugurated the Financial Literacy Day program at the bank’s head office on Monday, 3rd March 2025.

In the discussion meeting organized on this occasion, the essence of financial literacy including the understanding of financial literacy, fundamental model of financial literacy for individual financial behavior, individual investment model, spreading of financial knowledge about banking products and services among the customers and protecting customer deposits were discussed.

As part of the celebration of Financial Literacy Day 2025, Branches, Sub-branches and Agent Banking Centers organized discussion meetings in their respect areas at schools, colleges, madrasas, universities and marginal communities regarding financial awareness and personal financial risk management. The following three important issues were also particularly streamlined:

- Cash withdrawal and transfer through thumb print in the Agent Banking Centers.

- Need for transaction to be done inside the MDB Agent Banking Centre and with the specific Agent Official.

- After completion of transaction, machine printed original receipt must be collected and ensure receipt of SMS alert in the registered mobile phone.

Members of the Financial Literacy wing, Md. Rashed Akter, Head of Retail Distribution & Head of Financial Literacy wing and Chief Bancassurance Officer (CBO), Imran Al Habib, Head of Agent Banking, Khondoker Imran Hossain, Manager, Project, Process, Product Development & Digital Transformation and Mohammad Faruq Ur Rahman, member Secretary of Financial Literacy wing of Midland Bank were also present in the program along with other officials.

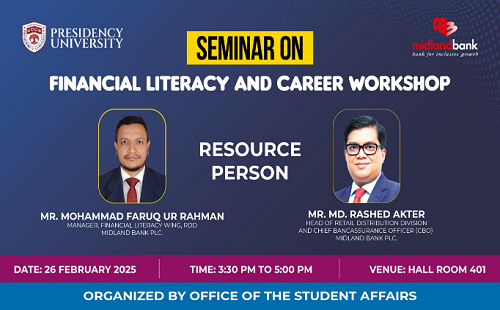

Seminar on Financial Literacy and Career Workshop at Presidency University

Seminar on Financial Literacy at SUST

Financial Literacy Booth of Midland Bank PLC. at DUET Campus, Gazipur

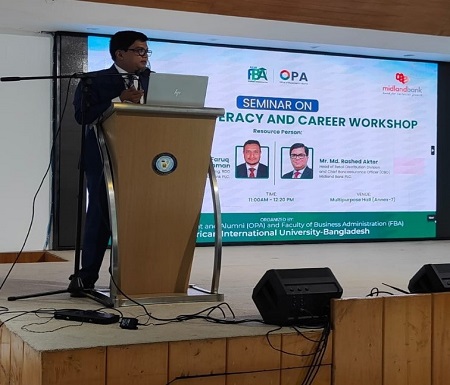

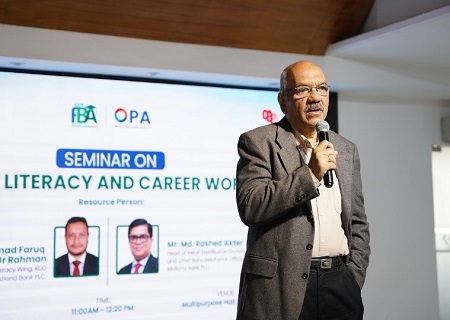

Seminar on Financial Literacy and Career Workshop at AIUB

Activities of Financial Literacy Week, 2025

Activities of Financial Literacy Day, 2025

Financial Literacy Program at Presidency University on February 26, 2025

Financial Literacy Program at SUST on February 25, 2025

Financial Literacy Booth of Midland Bank PLC. at DUET Campus, Gazipur

Seminar on Financial Literacy and Career Workshop at AIUB

2024

Financial Literacy Day-2024 has been celebrated by Midland Bank PLC. Md. Ahsan-uz Zaman, Managing Director & CEO of the Bank, inaugurated the Financial Literacy Day programme at the bank’s head office on Monday, 4th March 2024.

In the discussion meeting organized on this occasion, various issues including increasing awareness of banking products and services, protecting customer deposits, providing loans and settling customer complaints were discussed including sending expatriate remittance through legal channels. Following three important issues also discussed in the meeting:

- Cash withdrawal and transfer through thumb print in the Agent Banking Centres.

- Need for transaction to be done inside the MDB Agent Banking Centre and with the specific Agent Official.

- After completion of transaction, machine printed original receipt must be collected and ensure receipt of SMS alert in the registered mobile phone.

Members of the Financial Literacy wing Mohd. Javed Tarek Khan, Head of Institutional Banking, Md. Nazmul Huda Sarkar, CTO, Ashraful Alam, Acting Head of Operation Division, Md. Rashed Akter, Head of Retail Distribution & Head of Financial Literacy wing, Imran Al Habib, Head of Agent Banking & member Secretary of Financial Literacy wing of Midland Bank were also present in the programme along with other officials.

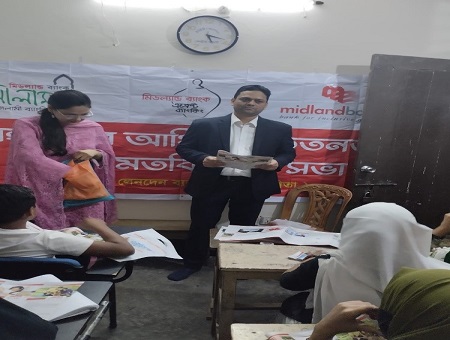

As part of the celebration of Financial Literacy Day 2024, Branches, Sub-branches and Agent Banking Centers organized discussion meetings at schools, colleges, madrasas, universities and marginal communities regarding financial awareness and bringing foreign remittance through banking channel.

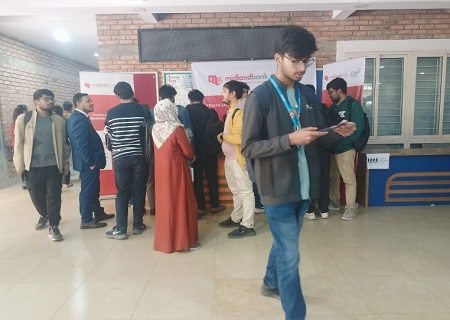

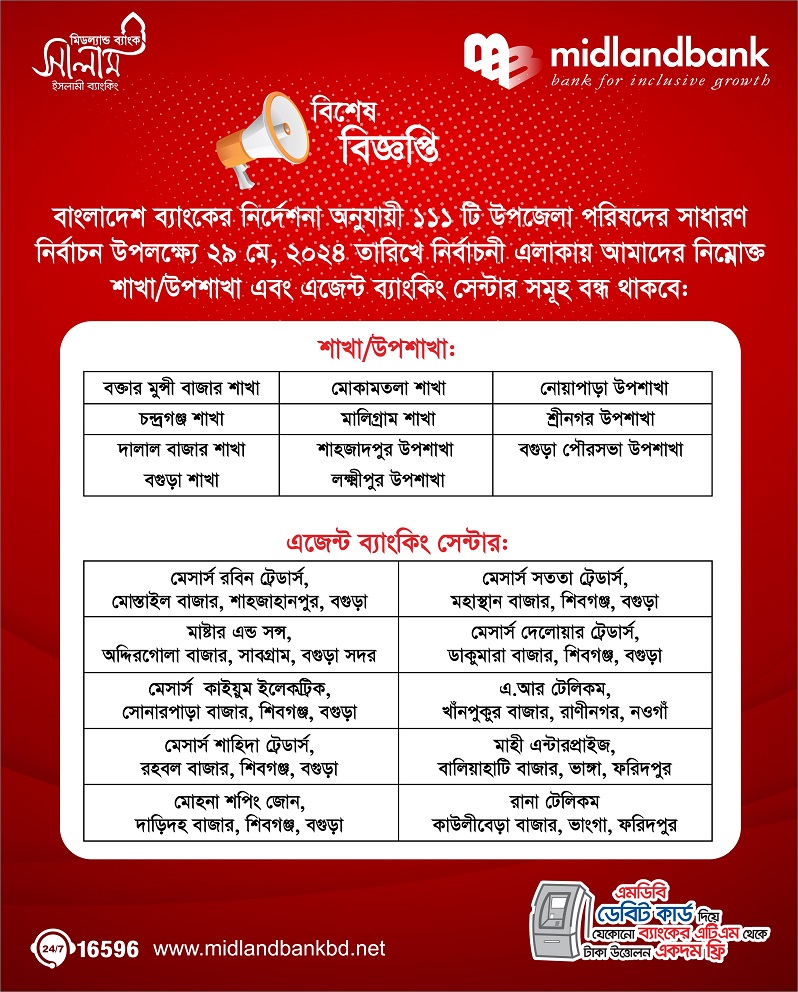

Nationwide Financial Literacy Week conducted by MDB Branches, Sub- Branches & Agent Banking Centres at their premises from 18-24 March, 2024. Customer awareness on the use of digital banking transaction and its benefits (ডিজিটাল লেনদেনের ব্যবহার ও উপকারিতা) as well as banking operations related issues were discussed in the program.

Nationwide Financial Literacy Initiatives conducted by MDB Branches, Sub- Branches & Agent Banking Centres.

Various categories of valued customer including Farmer, Foreign remittance beneficiary, Student, Garments Workers & Small Shop owner participated on the financial literacy awareness session.

Financial Literacy Programs in August, 2024 conducted by MDB Branches and Sub- Branches.

Financial Literacy Programs in September, 2024 conducted by MDB Branches, Sub- Branches & Agent Banking centers.

Financial Literacy Programs in November and December, 2024 conducted by MDB Branches and Sub- Branches.

Activities of Financial Literacy Day

Activities of Financial Literacy Week

SME Banking Activities

Financial Literacy Activities of MDB Branches and Sub- Branches in August, 2024

Financial Literacy Activities of MDB Branches, Sub- Branches & Agent Banking centers in September, 2024

Financial Literacy Activities of MDB Branches and Sub- Branches in November and December, 2024

2023

Financial Literacy Day 2023 has been celebrated by Midland Bank PLC. Md. Ahsan-uz Zaman, Managing Director and CEO of the Bank, inaugurated the Financial Literacy Day programme at the bank’s head office on Monday, March 6, 2023.

In the discussion meeting organized on this occasion, various issues including increasing social awareness, protecting customer deposits, providing loans and settling customer complaints, were discussed with the aim of sending expatriate income through legal channels.

Mohd. Javed Tarek Khan, Head of Institutional Banking and Member of the Financial Literacy Wing; Md. Rashed Akter, Head of Retail Distribution & Head of the Financial Literacy Wing; and Imran Al Habib, Head of Agent Banking and Member Secretary of the Financial Literacy Wing of Midland Bank were also present in the programme along with other officials.

Also, as part of the celebration of Financial Literacy Day 2023, various branches, Sub-branches and Agent Banking Centres organized discussion meetings at schools, colleges, madrasas, universities and marginal communities regarding financial awareness and bringing foreign remittances through the banking channel.

Conducted by Head of Retail Distribution Division Mr. Md Rashed Akhter.

MDB Chandragonj Branch, Feni organized financial literacy program among the territory. Head of Retail Distribution Division Mr. Md Rashed Akhter, Head of Agent Banking Division Mr. Imran Al Habib Xulius, Head of Retail sales Md Ashraful Islam, Head of Cluster & Head of Shashongacha Branch Md. Tahidul Amin Mojumder, Head of Dalal Bazar Branch Asaduzzaman khan were attended the program. Head of Retail Distribution Mr. Md Rashed Akhter puts valuable speech & shares his knowledge regarding MDB digital products & services.

গ্রাহক সমাবেশ

Organized by Doshmile Branch, Dinajpur & Chadragonj Branch, Feni.

Our colleagues from Doshmile Branch, Dinajpur & Chadragonj Branch, Feni, attended and conducted brief financial literacy sessions for the participants. We discussed the features of MDB products and services and the risks and problems with informal channels like Hundi for remittance beneficiaries.

WORKSHOP ON FINANCIAL LITERACY & DIGITAL INNOVATION IN BANKING SECTOR

MDB CDA Avenue and Agrabad Branch organized a workshop on financial literacy and digital innovation in the banking sector at GAM Chartered University College in Chattogram on 07.06.2023. During these workshops, the benefits of using banking channels for remittance and the advantages of MDB digital products and services are discussed, along with building awareness against informal channels of remittance.

UTHAN BOITHOK (উঠান বৈঠক) & ACCOUNT OPEN

Organized by MDB Agent Banking on 13.06.2023

MDB Agent Banking Fighters conducted Uthan Boithok at Niamatpur, Naogaon in order to achieve social and economic prosperity for the Garo community. These customer engagement sessions, focusing chiefly on females who are living in remote areas of the country, invite existing and prospective migrants and their beneficiaries.

FOREIGN REMITTANCE WORKSHOP

Agent Field Officers (Agent staff) of 30 Agent Banking Centers & Remittance Beneficiaries in the Bogra & Mokamtola regions participated in the workshop on 10.06.2023 where the following topics were discussed:

- Remittance business development initiatives.

- Knowledge sharing from top five (5) remittance disbursement Agent Banking Centers to increase remittance transactions.

- The challenges of low remittance performing AB Centers and what initiatives can be taken to improve them.

- Gifts for remittance beneficiaries to motivate them to come to MDB

- Increase the number of remittance exchange houses for the agent banking channel.

- Increase agent commission against remittance transactions.

- Marketing for agent banking Centers business growth.

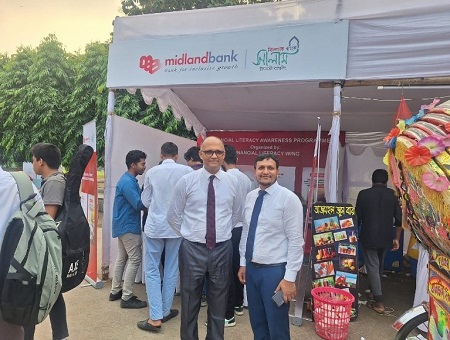

SME BANKING ACTIVITIES

MDB SME Department conducted fair at Southeast University, Ahsanullah University of Science and Technology and Independent University Campus on 04.06.2023, 21.06.2023 and 23.08.2023 respectively to explain the CMSME Financing Facility for Start-Up Businesses and how the Bank can assist with start-up business ventures among university students and faculty members.

FINANCIAL LITERACY AWARNESS PROGRAMME & SALES CAMPAIGN AT BANGLADESH UNIVERSITY OF BUSINESS & TECHNOLOGY AND PRESIDENCY UNIVERSITY CAMPUS

MDB Retail Sales Department conducted a Financial Literacy Program and Sales Campaign, at Bangladesh University of Business and Technology (BUBT) on 11.07.2023 and Presidency University campus on 25.07.2023. Through this campaign, MDB raises awareness of banking products and services among university students and faculty members while simultaneously promoting a variety of MDB products and services including savings account, student account, FDR, scheme deposit, personal loan, auto loan, home loan, e-saver, digital FDR, digital loan, prepaid cards, credit cards, midland online (internet banking), bank to bank transfer, fund transfer to and from MFS, utility bill payments, Mobile top-up etc.

Financial Literacy Sessions

গ্রাহক সমাবেশ & Workshop on Financial Literacy & Digital Innovation in Banking Sector

Financial Literacy Awareness Programme & Sales Campaign

UTHAN BOITHOK (উঠান বৈঠক) & Foreign Remittance Workshop

SME Banking Activities

Program conducted by Mymensingh Sub-Branch at Bagnabarir Char, Gouripur, Mymensingh on 20 December, 2023

Program conducted by Agent Banking at Shingherchar, Rupsha, Khulna on 21 December, 2023 & Dakhin Khanpur, Sadar, Bagherhat on 15 August, 2023

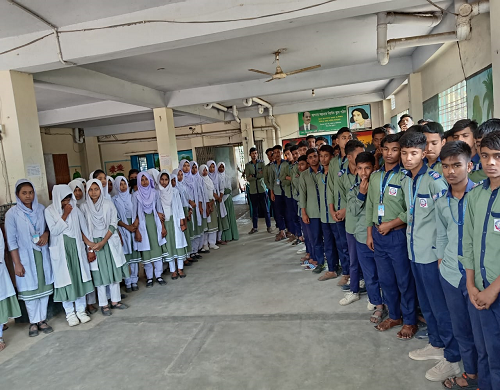

Program conducted by Chandraganj Branch, Lakshmipur Sadar at Ibrahim Mia Girls High School on 20 September, 2023 & Protapganj High School on 27 September, 2023 Chandraganj, Lakshmipur Sadar

Program conducted by Maligram Branch at Baliyahati Bazar, Bhanga, Faridpur on 19 September, 2023 & Shekhpura Bazar, Bhanga, Faridpur on 20 December, 2023

Program conducted by Sylhet Branch at Tea Garden, Airport, Sylhet Sadar on 07 December, 2023

Program conducted by Dhanmondi Branch at Junior Labortary High School, Dhanmondi, Dhaka on 26 September, 2023 & Rangpur Branch at Makura, Deuty , Pirgacha, Rangpur 17 October, 2023