Midland Bank Limited (MDB), a 4th generation Private Commercial Bank in the country completed 7th year of its commercial operation.

On this auspicious occasion Md. Ahsan-uz Zaman, Managing Director & CEO in his speech conveyed best wishes and thanks to all for the successful completion of 7th year of the Bank. The Managing Director, while expressing gratefulness to clients, shareholders, regulators and staff, told that the Bank, as part of its anniversary celebration, introduced one new product titled, MDB e-Saver along with a similar product for Midland Bank Saalam Islami Banking Window named MDB Saalam e-Saver for the unbanked masses under Bangladesh Bank’s recently announced e-KYC policy; and one new business, MDB Offshore Banking for its foreign trade clients and clients who want to open accounts in foreign currency.

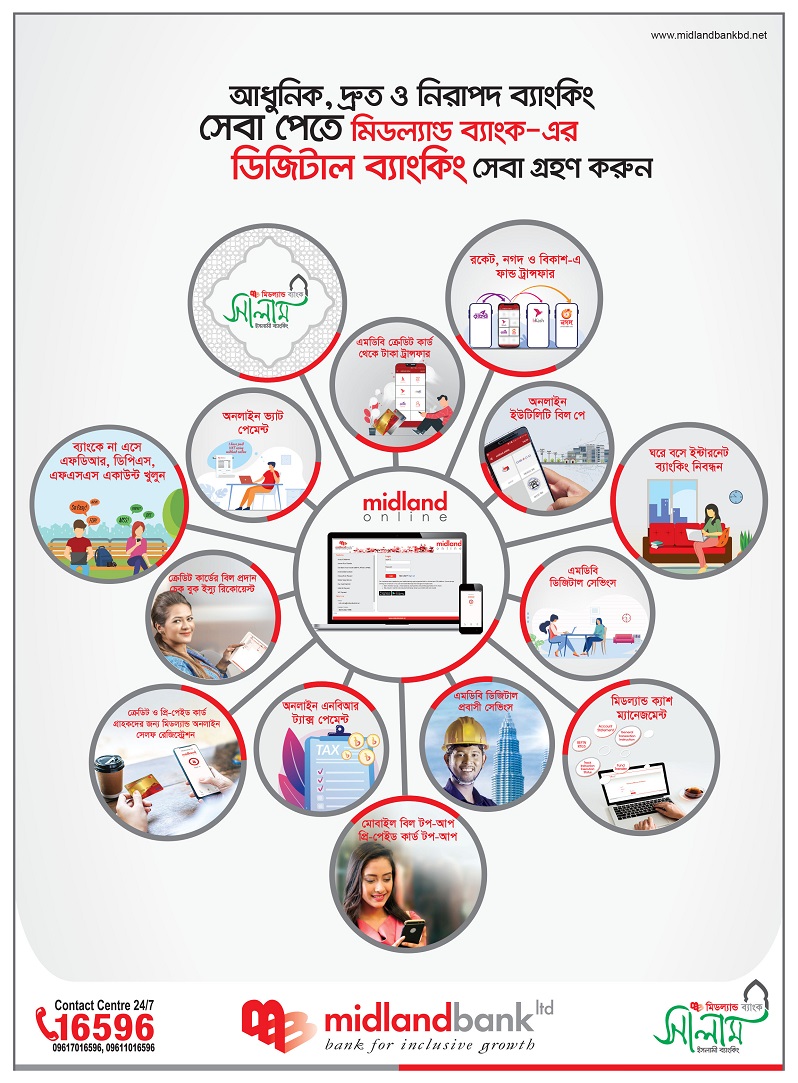

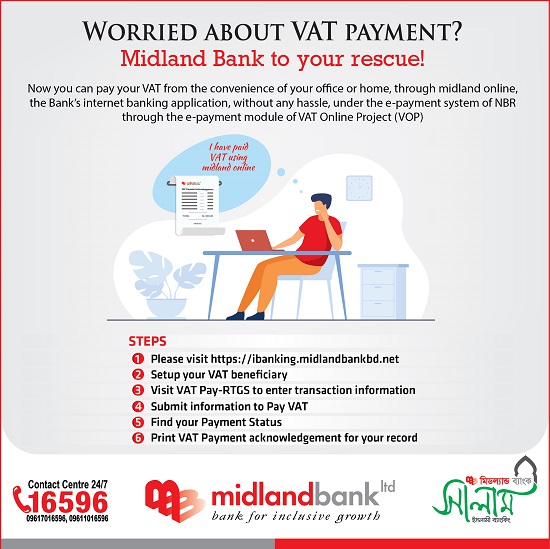

He told, MDB has always been in the forefront of implementing technology based solutions. The Bank offers multiple customized solution to its valued customers to meet their varied needs. MDB e-Saver and MDB Saalam e-Saver Accounts are the new additions under the technological advancement of the Bank. Both are paperless savings account introduced to facilitate the customers who have limited transaction needs and can be opened at any Branch, Sub-Branch and soon at any Agent Banking Centre of MDB. The products are designed in such a way that the customers can open the account using only NID card, using biometric or facial recognition technology. MDB e-Saver Account holders will also be able to avail all the hassle-free digital services like SMS alert of any transaction to mobile phone, free monthly e-statement and online fund transfer through BEFTN, NPSB, RTGS, bKASH. He expressed the hope that under the e-KYCguideline of Bangladesh Bank, MDB e-Saver Account is going to be the most user-friendly, affordable and smart account in today’s Banking Industry.

He further informed, with a view to catering to the Banking requirements of Non-Resident customers, Midland Bank has established Offshore Banking Unit (OBU) at its Gulshan and Agrabad Branch. He added, OBU acts as a unique solution for the Banks around the globe to carry out international Banking business, which involves foreign currency denominated assets and liabilities taking the advantage of internationally competitive pricing for the clients. MDB Offshore Banking services is specially tailored for 100% foreign owned company, joint venture and locally owned company in Export Processing Zones (EPZ), Export Zones (EZs) and High Tech Park.

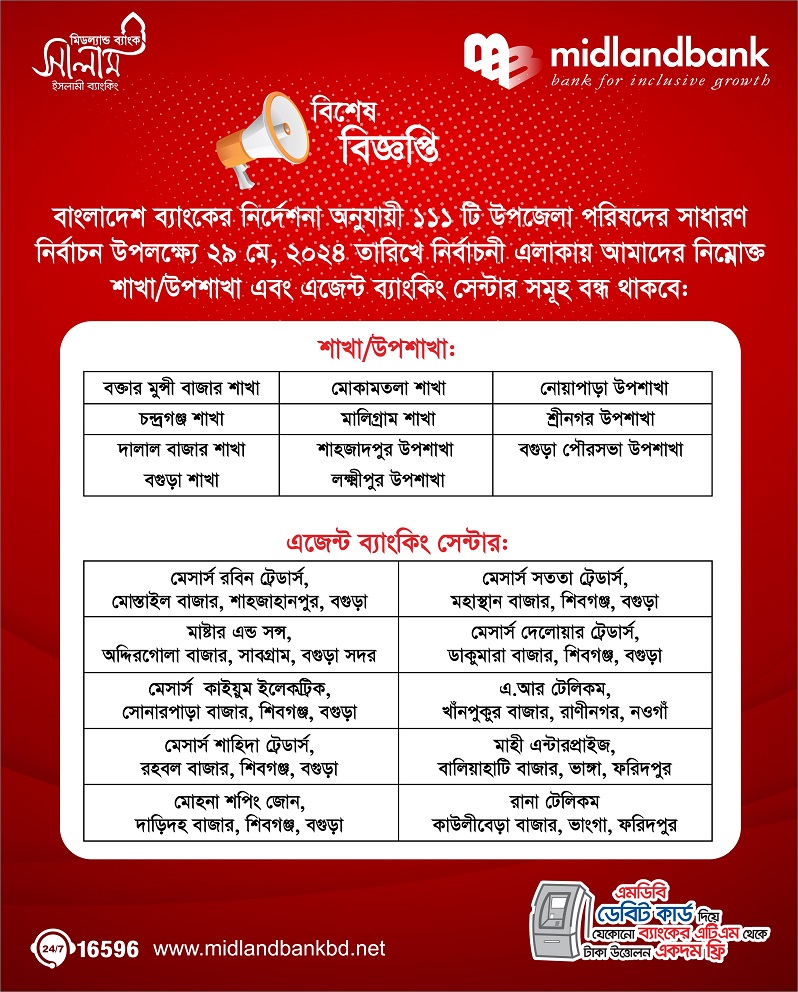

He also mentioned that the Bank has already made Banking services available at the door-step of the un-banked population, seeking financial inclusion, with the introduction of Agent Banking. The Managing Director re-iterated the Bank’s commitment to providing modern and customer friendly services to its customers.

On the occasion of 7th Anniversary, dua session was held at Head Office of the Bank with social distancing on 20.06.2020. Considering the current pandemic situation, the Bank postponed its anniversary celebration programme both at its branches, sub-branches and Head Office.